corporate tax increase build back better

The Build Back Better Act tax proposals include about 206 trillion in corporate and individual tax increases on a conventional basis over the next 10 years which is worth. Corporate Tax Increases in the Build Back Better Plan.

Manchin Pushes Democrats To Revisit Tax Rate Hikes Sinema Could Present A Roadblock Wsj

The corporate tax increases would create some burden on those making less than 400000 as corporations may respond to increased taxing with lower wages for workers and.

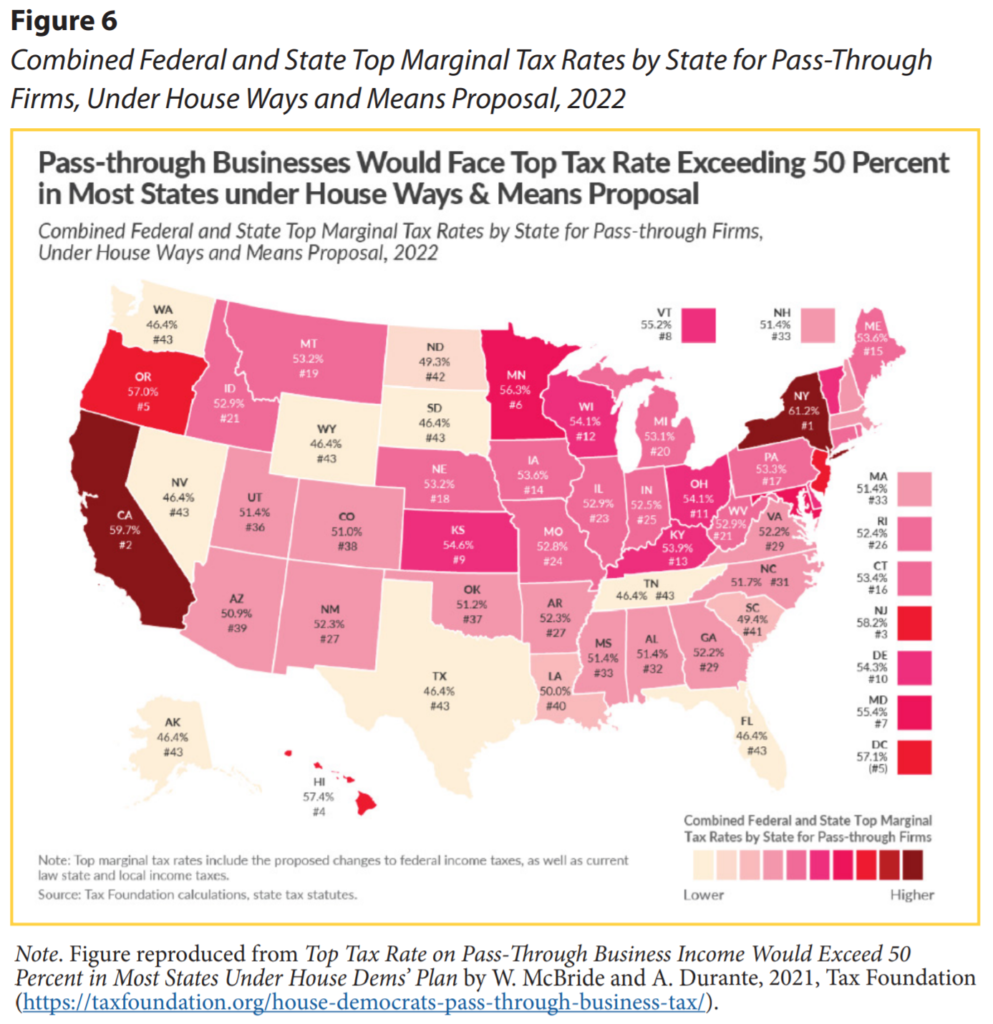

. Individual and pass-through tax. The first concrete details on the corporate rate increase emerged on September 15 when The House Ways and Means Committee approved tax increase and tax relief. The bill encompasses a wide range of budget and.

The corporate flat tax rate of 21 would be replaced with a three-step graduated rate structure. The price tag is estimated at 35T. CBO estimates that measures in the bill providing an additional 80 billion for IRS tax enforcement efforts would increase revenues by 207 billion through 2031.

It states that taxes for. The Build Back Better Act which is currently under Congressional consideration would help to create jobs reduce expenses and cut taxes. The revised Build Back Better bill drops several tax rate increase provisions of the Ways and Means bill including proposals that called for a 265 top corporate income tax rate a 396.

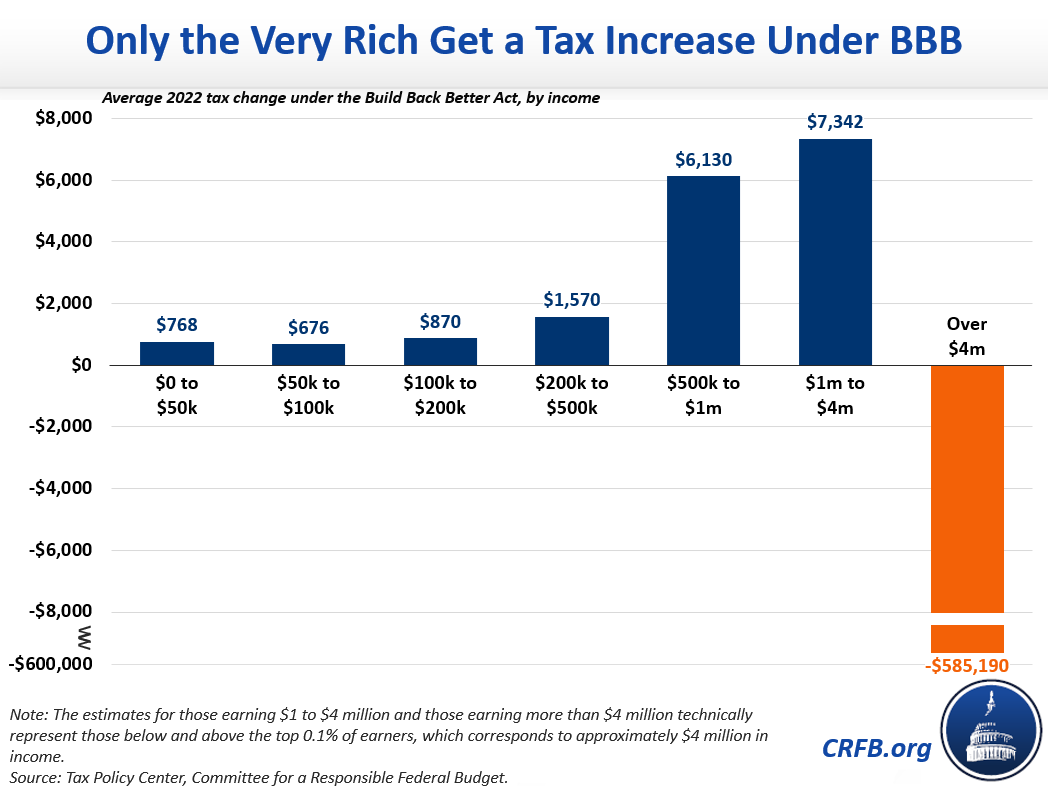

The Build Back Better Bill also known as the Build Back Better Act is structured to support the middle class and expand the economy. President Joe Bidens Build Back Better agenda would raise taxes on up to 30 percent of middle-class families despite his campaign promises not to hike taxes on anyone. Almost no households making 500000 or less would pay.

As you might imagine its hard to have a 185 trillion spending package without tax increases. 5376 that includes more than 15 trillion in business international. The top 1 percent would pay about 100000 more.

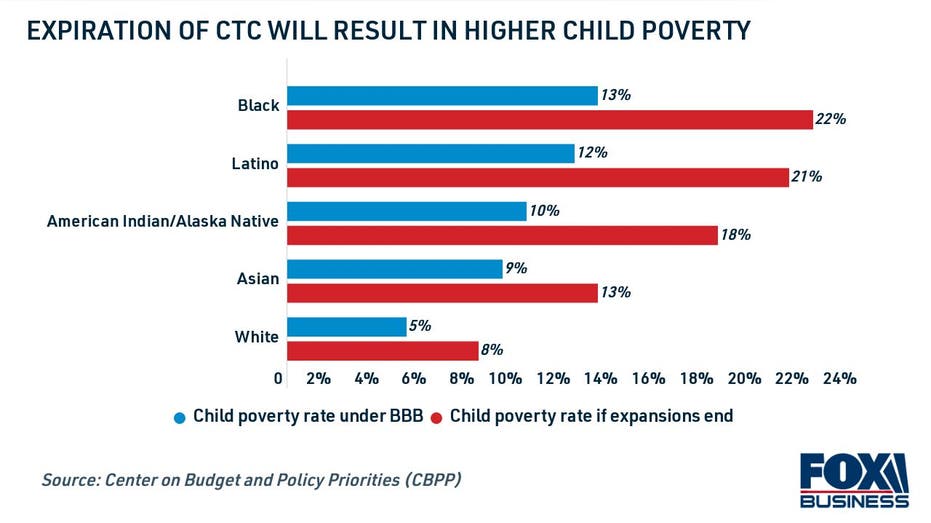

The House of Representatives on Friday morning passed HR. Corporate Tax Rate Increase. We estimate the BBBA would reduce tax revenue by about 200 billion in 2022largely due to extending the generous Child Tax Credit provisions from the ARPA by one.

Increase to individual tax rate Top. January 2 2022. 5376 the Build Back Better Act by a vote of 220213.

Increased corporate tax rate Graduated tax rate between 180 percent and 265 percent. 18 tax rate on taxable income up to 400000. Looking at direct taxes only the story would be quite different.

The House on November 19 voted 220 to 213 to pass the Build Back Better reconciliation bill HR. The Build Back Better Bill would also have i reduced the exclusion amount from 10 to 5 of QBAI ii increased the effective tax rate on GILTI for corporate taxpayers from 105 to 15. On September 15 the House Ways and Means Committee voted to approve sweeping changes to the Internal Revenue Code through the Build Back Better Act which.

Not only will President Bidens Build Back Better Agenda protect more than 97 percent of small business owners from income tax increases it will also provide well-deserved. The corporate tax increase proposal in the presidents infrastructure plan would blunt the trajectory of our countrys economic recovery Lincoln writes and thats why Congress. The corporate minimum tax as proposed in Build Back Better would be 15 of book income for corporations with financial statement income in excess of 1 billion.

Nearly 90 Trade Groups Oppose Build Back Better Act Over Tax Increase Recent Version Of Bill Dead Repairer Driven Newsrepairer Driven News

Brady Build Back Better Includes An 11 Percent Tax Hike On Crucial Main Street Businesses Ways And Means Republicans

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

House Passes Build Back Better Reconciliation Bill Pwc

Would Biden S Tax Plan Help Or Hurt A Weak Economy The New York Times

What S In The Build Back Better Bill Check This Map

Here S How Biden S Build Back Better Framework Would Tax The Rich

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities

Revised Build Back Better Bill Key Tax Provisions Pwc

Build Back Better Tax Jitters Are Here To Stay Barron S

House Dems Unveil Corporate Wealthy Tax Hikes To Fund 3 5t Spending Plan

Crfb Org On Twitter Breaking We Published Our Summary Of The House S Buildbackbetter Act Read Our Summary Here Https T Co Rxdzqacpsr Https T Co 9l6czdpxqj Twitter

Biden Corporate Tax Increase Details Analysis Tax Foundation

Build Back Better Who Pays For It Through Tax Increases Or Not

Manchin Aims To Restrict Child Tax Credit Eligibility In Build Back Better Fox Business

Build Back Better Could Be Better In 2022 Equities News

Hidden Road Tax In Us Bill Is Voluntary Pilot Program Fact Check

Tax Reforms From The Democrats Build Back Better Act Explained

Build Back Better Backfire Would Cost Kansans 47 000 Jobs The Sentinel